In India, a Public-Sector Banking Crisis is brewing!

- Vinay Nair

- Aug 2, 2020

- 4 min read

Updated: Aug 3, 2020

Indian banking sector was revolutionized in 1969, when former PM Indira Gandhi passed a resolution to nationalize 14 of the largest private sector banks in India. The Reserve Bank of India went on to say that this was the most important economic decision taken by the government since 1947.

The decision to nationalize banks was a result of political, social and economic factors prevailing in the country during that period.

Social Factors

The share of credit for agriculture sector was just about 2%.

Private sector banks in India were run by prominent industrialists and they provided loans to their own facilities. Indian banks were heavily criticized for not offering credit facilities to agriculturists, small and medium enterprises. Another reason for nationalising banks was to sync the banking sector with the goals of socialism adopted by the Indian government after independence.

Political factors

India was going through a political turmoil in the 1960’s.

India fought over border issues with China in 1962, and Pakistan in 1965. At the same time, the sudden demise of Former PM Lal Bahadur Shastri, led to the appointment of Indira Gandhi as the 3rd Prime Minister of India on January 1966. The Indian National Congress (INC) soon lost a number of seats in the Lok Sabha Elections of 1967 and subsequently lost power in seven states. Senior Party Leaders (especially the "Syndicate") wanted banks to be nationalised and to be neutralised.

Economic Factors

India experienced double digit inflation & a negative GDP growth rate.

Two droughts in the 1960’s caused a major economic distress and saw the decline of Foreign reserves. These factors caused the government to devalue the Indian National Rupee (INR) and charge export duties on certain commodities. Gandhian-disciple PM Lal Bahadur Shastri’s government had set into motion key campaigns to save the Indian economy. He promoted the White Revolution & Green Revolution to boost India's food production, but his term was short-lived given his untimely death, and it was up to Indira Gandhi to take over the reigns.

After careful consideration Indira Gandhi decided that banks would have to be nationalized to align their objectives with national and social development. Before the policy was implemented a National Credit Council (NCC) was formed to align the banks objectives with the nations. NCC considered doubling credit facilities to sectors like agriculture and small and medium enterprises. The banks portrayed to the council that there was no need for nationalisation and that they had the country’s social goals in mind. Promoters of various banks came out to say that no argument could favor a nationalisation of banks but none of these claims or statements had any impact on the final decision.

On July 19, 1969, The Banking Companies (Acquisition and Transfer of Undertakings) Ordinance resulted in the ownership of 14 banks being transferred to the state.

Atal Bihari Vajpayee describes the action as ashobhinya (ugly), anuchit (improper), akaran (without justification) and anaavashyak (unnecessary).

51 Years Later, Banking Sector Today!

The move to nationalise the banks did not actually benefit anyone. The reform was said to have been carried out by Indira Gandhi to weaken the businesses (w/ banks) that backed the opposition and is considered to be a political reform rather than a socio-economic one. The public sector banks now had to manage various interest rates for different types of loans, which ultimately lead to chaos in the Indian banking system. She also promised some amount of autonomy for the banks but did not fulfil her promises for too long to be effective. A noteworthy outcome from this reform was the increase in number of branches and expansion of banking services to rural areas. This definitely led to credit being channelised for agriculture, small and medium industries. Banks had to reserve as much as 40% of credit to these priority sectors.

But, the nationalisation of banks did more harm than good and lead to many scams in the following years. The growth rate of Non Performing Assets (NPA) is much higher in nationalised banks when compared to private sector banks. Business groups were borrowing tremendous amounts of money from various public sector undertaking banks, without offering any credit protection.

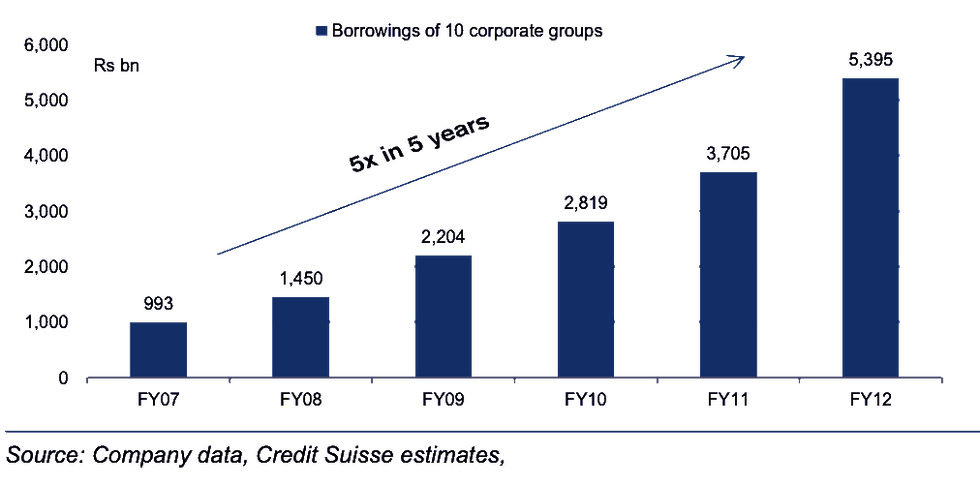

Ashish Gupta gave an insight into the dangerous levels of borrowings in 2012 through his report “House of Debt” with Credit Suisse

The nation's bad loan figures were changed from 3% to 9.3% after reviewing banks’ bad loan books. This was unraveled after identifying inadequate interest coverage ratios in certain sectors of the economy.

He believes that private banks have become more risk averse and are preserving liquidity since the Yes Bank crisis.

This will cause further harm to the credit crunch in the Indian economy.

One of the most infamous and recent banking frauds involving a nationalised bank was the Punjab National Bank (PNB) Scam, where Nirav Modi, Mehul Choksi, their relatives, and partners along with certain PNB employees used fake Letters of Undertaking to import pearls. The scam amounted to a whopping 14,000 crores rupees.

Another such scam was carried out by United Spirits and Breweries owner Vijay Mallya. While running a loss-making business, he continued to take loans to keep his business afloat. His loan book amounted close to 9000 crores rupees borrowed from 17 banks.

The coronavirus outbreak has put more pressure on banks as the government has made provision to extend the moratorium for loans.

As of 2019 the NPAs of public sector banks amount to 7 lakh crore rupees with frauds worth more than 1 lakh crore rupees.

Public sector banks are on the verge of facing a liquidity crisis and the government continues to infuse liquidity using public tax revenue to stir demand and boost lending. The bond yields on treasury bonds have been rising, putting pressure on the government again.

The Modi government has made some efforts to resolve the cause and effect of the nationalisation of 1969 by consolidating 27 PSU banks into 12 nationalised banks, but that does not really solve the problem.

Economists are surprised that the Prime Minister Narendra Modi-led BJP government has not considered reversing the ordinance passed by then ruling party-INC lead Indira Gandhi.

Over that the pandemic has only fueled the fire for nationalised banks

The Government needs to reduce its influence over these Banks.

Public sector banks account for more than 80% of the bad loans owing to their failure of identifying poor performing assets.

False reporting is a major problem in PSU banks which can only be solved by privatisation.

The sun is setting over the public banking sector, and the government has to douse it out in time to save itself from an imminent crisis situation.

Comments